From Dangers to Incentives: Personalized Insurance Policy Solutions to Safeguard Your Way Of Living and Investments

Are you looking for insurance solutions that are tailored to your special lifestyle and investment demands? By determining the threats that intimidate your assets, customizing protection to fit your particular demands, and leveraging insurance to secure and grow your financial investments, you can make the most of the benefits while decreasing potential losses.

The Relevance of Personalized Insurance Providers

Individualized insurance solutions are critical for shielding your way of living and investments. A one-size-fits-all technique simply will not reduce it when it comes to securing what matters most to you. You require insurance policy that is tailored particularly to your unique needs and scenarios.

By choosing individualized insurance coverage services, you can make sure that your coverage aligns with your way of life and gives the necessary protection for your investments. Whether you own a home, a car, or run a service, having the appropriate insurance coverage in position can give you with assurance and monetary safety and security.

With personalized insurance coverage services, you have the chance to function closely with an insurance coverage professional who will certainly examine your individual demands and risks. This permits a detailed assessment of your properties and assists recognize any possible gaps in your insurance coverage. By dealing with these voids, you can avoid pricey surprises in the occasion of a mishap, burglary, or natural catastrophe.

Additionally, personalized insurance policy solutions enable you to customize your coverage limitations and deductibles according to your budget plan and threat resistance. This versatility makes certain that you are not underinsured or overpaying for insurance coverage that you may not require.

Assessing Risks: Identifying the Risks to Your Lifestyle and Investments

You can recognize the hazards to your way of life and investments by assessing the possible dangers. It is crucial to comprehend the numerous factors that could weaken your monetary security and overall well-being. By carrying out a comprehensive evaluation, you can proactively guard your assets and make notified choices to minimize potential losses.

Start by assessing the prospective risks to your way of living. Take into consideration aspects such as your health, occupation, and individual conditions. If you have a physically demanding task, the danger of injury or ailment might be greater. Likewise, if you have dependents or considerable financial commitments, unanticipated events like the loss of a job or a medical emergency situation can posture a threat to your way of living.

Following, evaluate the threats to your financial investments. Identify the potential volatility and direct exposure of your profile. Think about variables such as market variations, economic problems, and geopolitical threats - Home Insurance Eden Prairie. For example, if you have significant investments in a particular sector or area, adjustments in policies or political instability might influence your returns.

Tailoring Coverage: Customizing Insurance Coverage Program to Fit Your Requirements

When customizing coverage, it's essential to consider your certain demands and situations. Insurance strategies should be tailored to fit your way of life and shield your financial investments. Whether you're a homeowner, an entrepreneur, or a high-net-worth person, discovering the best insurance coverage is crucial.

Beginning by examining your dangers and determining what locations need the most defense. Are you worried about residential property damage, liability cases, or potential loss of revenue? Comprehending your priorities will certainly help you pick the best coverage choices.

As your conditions alter, your insurance coverage needs may develop. Insurance policy is not a one-size-fits-all service.

Collaborate with a knowledgeable insurance policy representative who can guide you with the procedure of personalizing your coverage. They can assist you browse through This Site the different plan options and discover the most effective fit for you. Remember, personalized insurance policy solutions are developed to guard your lifestyle and financial investments, making certain that you have the best security when you require it most.

Maximizing Benefits: Leveraging Insurance Policy to Protect and Expand Your Investments

By assessing your requirements and collaborating with a knowledgeable agent, you can customize protection to shield and grow your investments. Insurance coverage is not almost securing your properties; it can also be an effective device to maximize your benefits. With the appropriate coverage in location, you can feel great recognizing that your investments are shielded from unanticipated risks and possible losses.

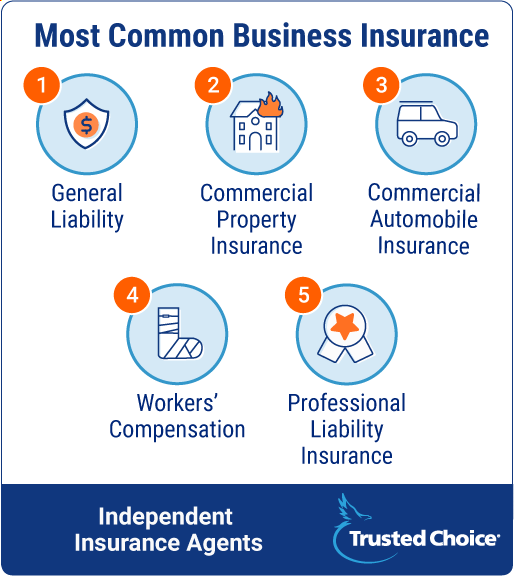

One method to utilize insurance policy to safeguard your financial investments is with residential or commercial property insurance coverage. Whether you possess a home, rental residential properties, or business actual estate, having the appropriate insurance policy coverage can guarantee that your investments are secured versus damage or loss. This can consist of insurance coverage for all-natural catastrophes, fire, theft, and liability.

In enhancement to securing your investments, insurance coverage can also aid you expand your riches. By choosing plans that provide investment opportunities, such as life insurance policies with cash money worth elements or annuities, you can make the most of the potential for growth with time. These sorts of policies permit you to collect funds that can be utilized for future economic objectives or even as an income source during retirement.

To make the most of your insurance protection and optimize the benefits for your investments, it is necessary to frequently review and upgrade your policies. This guarantees that your protection straightens with your existing needs and goals. By dealing with a seasoned representative that understands your distinct scenario, you can tailor your insurance coverage to protect and expand your financial investments efficiently.

Choosing the Right Insurance Policy Supplier: Examining Choices for Personalized Solution

When picking an insurance coverage carrier is the degree of service they offer to tailor protection to your details needs,One essential factor to think about. You desire to ensure that the insurer understands your special scenarios and can offer you with a customized service that fulfills your demands - Auto Insurance Eden Prairie. When assessing insurance policy choices, it is crucial to look for suppliers who exceed and beyond to customize their services for you

An excellent insurance service provider will certainly make the effort to recognize your way of living, assets, and goals before advising a coverage plan. They will ask you thorough questions regarding your needs and preferences, and afterwards use this info to design a policy that is tailored to you. This degree of customized service guarantees that you are getting one of the most out of your insurance policy protection, and that you are not paying for unneeded or pointless securities.

Along with customization, a trusted insurance policy supplier will certainly also use recurring support and support. They will certainly be there to answer your questions, assist you browse the claims process, and make changes to your coverage as your requirements transform. This level of service makes certain that you are always protected which your insurance policy protection expands and adjusts with you.

Verdict

So there you have it! Individualized insurance policy services play a critical function in safeguarding your lifestyle and financial investments. By analyzing risks and tailoring protection to suit your particular demands, you can make best use of benefits and protect your hard-earned investments. It is necessary to pick the right insurance company that provides Learn More customized service and understands your unique conditions. Do not wait any type of longer, take the required actions to safeguard your learn this here now future and take pleasure in the peace of mind that personalized insurance solutions can bring.

By recognizing the dangers that threaten your properties, personalizing coverage to fit your specific needs, and leveraging insurance coverage to protect and expand your investments, you can optimize the benefits while decreasing prospective losses - Liability Insurance Eden Prairie.With customized insurance policy services, you have the chance to work carefully with an insurance expert that will certainly assess your individual demands and risks.One means to take advantage of insurance to safeguard your investments is with residential property insurance policy. Whether you possess a home, rental homes, or industrial actual estate, having the appropriate insurance policy coverage can ensure that your investments are protected versus damages or loss.One vital factor to consider when choosing an insurance policy provider is the level of service they provide to tailor coverage to your particular needs